Accounting for notes receivable can be burdensome and error-prone if approached manually. Sometimes a company receives a note when it sells high-priced merchandise; more often, a note results from the conversion of an overdue account receivable. When a customer does not pay an account receivable that is due, the company may insist that the customer gives a note in place of the account receivable.

DBRS Morningstar Finalizes Provisional Ratings on CNH Capital … — DBRS Morningstar

DBRS Morningstar Finalizes Provisional Ratings on CNH Capital ….

Posted: Wed, 24 May 2023 07:00:00 GMT [source]

The goal is to minimize the dollar amount of receivables that are old, particularly those invoices that are over 60 days old. Current asset less current liabilities equals working capital, and every business needs to generate enough in current assets to pay current liabilities. Financially sound companies have a positive working capital balance. The journal entry for interest on a note receivable is to debit the interest income account and credit the cash account. To show the initial recording of notes receivable, assume that on 1 July, the Fenton Company accepts a $2,000, 12%, 4-month note receivable from the Zoe Company in settlement of an open account receivable. For example, one month from July 18 is August 18, and two months from July 18 is September 18.

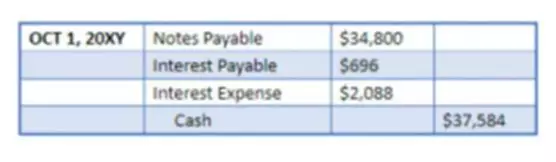

Notes Receivable:Interest Receivable Adjusting Entry

The Fenton Company should also indicate the default on the Zoe Company’s subsidiary accounts receivable ledger. When the borrower or maker of a note fails to make the required payment at maturity, the note is considered to have defaulted. In some cases, the term of the note is expressed in days, and the exact number of days should be used in the interest computation. In other cases, a customer’s credit rating may cause the seller to insist on a written note rather than relying on an open account.

Cambridge-Lee Holdings Consolidated Results of Operations for Q1 … — Business Wire

Cambridge-Lee Holdings Consolidated Results of Operations for Q1 ….

Posted: Fri, 02 Jun 2023 07:00:00 GMT [source]

Notes receivable can be between a business and any other party — another business, a financial institution or an individual. Most often, they come about when a customer needs more time to pay for a sale than the standard billing terms. As a trade-off for agreeing to slower payment, payees charge interest what is net price and require a signed promissory note for legal purposes. Employee cash advances where the company asks the employee to sign a promissory note are another way notes receivable come about. Most often, it comes about when a maker needs more time to pay for a sale than the standard billing terms.

What Is Net Receivables? Definition, Calculation, and Example

The unamortized net fees and costs shall be reported as a part of each loan category. The easiest way to handle bad debts is to use the direct write-off method. When you know that a bill will not be paid, you reclassify the receivable balance to bad debt expense. Offer your clients a discount (1% to 2%), if they pay within 10 days. You’ll lose some revenue with these payment terms, but you’ll collect some cash faster.

Net receivables are shown as an aggregated total on the company’s balance sheet. The gross receivables are listed first and are followed by the allowance for doubtful accounts. The allowance for doubtful accounts is a contra-asset account, as it reduces the balance of an asset. Accounts payable is an obligation that a business owes to creditors for buying goods or services. Accounts payable do not involve a promissory note, usually do not carry interest, and are a short-term liability (usually paid within a month). Your accounting software should provide an aging schedule for accounts receivable, which groups your receivables based on when the invoice was issued.

Example of Accounts Receivable

Every business should maintain a written procedures manual for the accounting system, and the manual should include specific procedures for managing accounts receivable. A procedures manual ensures that routine tasks are completed in the same manner each time, and the manual allows your staff to train new workers effectively. For example, you may email every customer when an invoice is later than 30 days, and call each client when an invoice is over 60 days old. If you enforce a policy, people will either start to pay you on time, or stop doing business with you (which may be fine, if they always pay late). Some firms charge late fees after a specific due date, and include the terms of the fee on each invoice.

Notes Receivable is an Asset account so it has a normal debit balance. Notes Receivable is increased on the debit (left) side of the account and decreased on the credit (right) side of the account. In addition, a company’s net receivables are highly subject to general economic conditions.

What Accounts Receivable (AR) Are and How Businesses Use Them, with Examples

The payee is the party that holds the note and receives payment from the maker when the note is due. Company A sells machinery to Company B for $300,000, with payment due within 30 days. Alternatively, the note may state that the total amount of interest due is to be paid along with the third and final principal payment of $100,000. Notes receivable appear on the balance sheet as an asset with a corresponding liability.

Notes payable are the corresponding liabilities on a maker’s books, also in the amount of outstanding principal. The business entity doing the lending has a note receivable and the entity doing the borrowing has a note payable. Notes receivable have a higher probability of payment than purchases made on simple credit, which are known as open trade receivables. That’s because of the signed promissory note, which can be presented as evidence in a legal proceeding. In addition, notes receivable can potentially be sold to third parties. By reducing unpaid, “bad” debts, collecting interest income and facilitating contract sales, notes receivable can be a tool for enhancing cash flow.

PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. The term remote is used here, consistent with its use in Topic 450, to mean that the likelihood is slight that a loan commitment will be exercised before its expiration. A loan is impaired when, based on current information and events, it is probable that a creditor will be unable to collect all amounts due according to the contractual terms of the loan agreement. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

- This can make bookkeeping cumbersome, especially for companies that hold multiple notes receivable.

- Notes receivable have a higher probability of payment than purchases made on simple credit, which are known as open trade receivables.

- Any amount of money owed by customers for purchases made on credit is AR.

- Sometimes, businesses offer this credit to frequent or special customers that receive periodic invoices.

- Note that since the 12% is an annual rate (for 12 months), it must be pro- rated for the number of months or days (60/360 days or 2/12 months) in the term of the loan.

Нет Ответов